How Much is Alternative Investment Data Entry Costing You?

Calculate and Gauge Your ROI

The operational costs of managing your employees and processes can be high. In alternative investment operations, simply managing your workflow related to documents, data extraction, and reporting can be extensive. In a prior post, we addressed the calculation of the efficiency and cost of manual data entry. But how do we more explicitly calculate our operational costs, and how do we improve efficiency to boost our ROI?

Technology That Eliminates Manual Entry

Wealth management and institutional investors require the processing of hundreds of thousands of different documents within their alternative investment portfolios in order to organize, calculate, and report performance internally and for clients. As we’ve outlined, these documents are disparately formatted and distributed on unscheduled cadences. Moreover, there can be data issues, missing values, restatements, complex text interpretations, and other factors, which can lead to serious errors and make the process overly time-consuming. The progression of smart technology has allowed for recognition, validation, and extraction of unstructured investment data, which can lead to massive gains in efficiency.

More specifically, there are a host of burgeoning and improving technologies like Ocular Character Recognition, Natural Language Processing, and Machine-Learning, that enable firms to reduce manual data entry and all the frustrations that come along with it. At Canoe, we’ve coupled these cutting-edge techniques with decades of investment experience and domain expertise to build a product that eliminates the need for expensive teams dedicated to time-consuming and error-prone manual data entry. This is good news for allocators, wealth managers, and institutional investors worldwide.

How Can You Determine the ROI of an Investment in a Product Like Canoe?

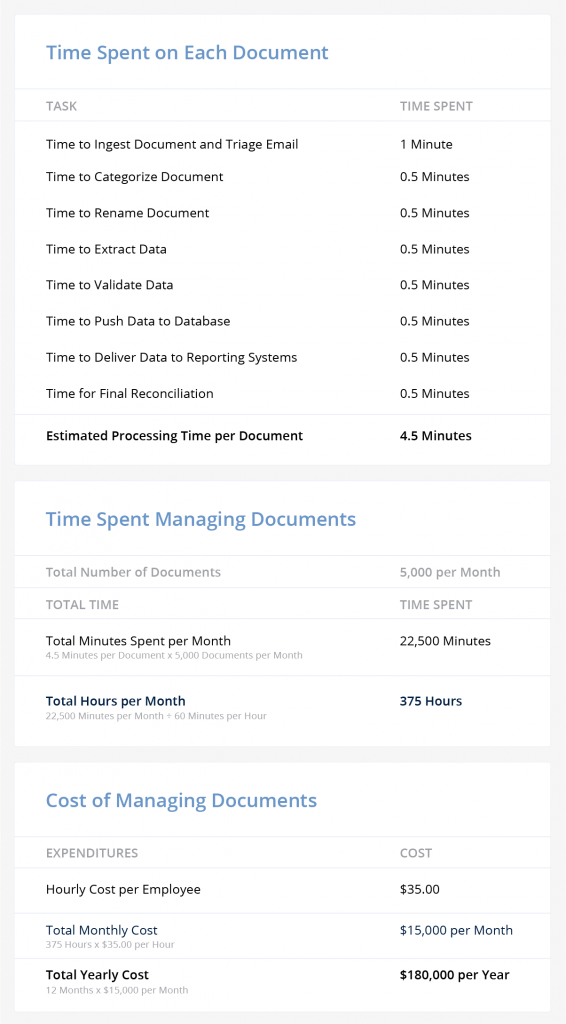

Through countless conversations with our clients, our partners, and well-known firms in the investment world, we have built a detailed algorithm to help determine the ROI for businesses trying to increase efficiency through the use of technology. As part of that algorithm, certain assumptions, data, and estimates are needed as a starting point:

- Total number of documents you ingest and manage each month (Capital Account Statements, Call/Distribution Notices, Performance Estimate Emails, Hedge Fund Factsheets, K-1s, Quarterly Letters, SOI, Financials, etc.)

- Average operational employee cost per hour

- Estimated processing time in minutes per document to:

- Ingest and triage emails

- Categorize store and rename files

- Extract all relevant data points

- Validate the accuracy of data points on a micro and macro level

- Standardize and push data to the database

- Feed that data into the downstream reporting and accounting systems of need

Here’s the Equation:

Total Number of Documents x (Estimated Processing Time per Document) = Total Minutes Spent per Month

(Values within parentheses are recorded in minutes spent on those tasks)

To determine the potential ROI quickly, gather the data listed above and plug your own numbers into the equation. We have provided an example of the current operational cost calculation of a mid to large-sized institutional investor, multi-family office, or wealth manager, processing around 5,000 documents each month:

Clearly, this is a time-consuming and costly process.

What is the Possible ROI of Using a Smart Platform?

While we don’t believe that technology will ever automate 100% of the alternative investment reporting process, we do believe there are significant benefits related to reporting turnaround times, data accuracy, team turnover, and employee satisfaction. On top of all of this, we’ve seen our clients reduce their overall operational costs by up to 80%. Using the previous example, your potential ROI with Canoe, including the cost of ownership, could be in the tens of thousands of dollars or more annually.

Empowering your team with smart technology to improve their efficiency not only reduces errors and improves quality control, but also can aid in improving employee satisfaction and retention. With Canoe, your team can refocus their time and energy away from manual data entry tasks and toward adding more value to your firm and your clients.